nevada estate tax return

Gift tax return engagement letter. File My Federal Return.

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

31 rows Florence KY 41042-2915.

. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1206 million in 2022 though you will be taxed on the overage not the entire. Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Find state-specific templates and documents on US Legal Forms the biggest online library of fillable legal. Starting 2018-2019 tax year a Commerce Tax filing requirement for those with Nevada gross revenue of 4000000 or less has been eliminated.

Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. However if the gross revenue of your. Aicpa tax consulting engagement letter.

For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. NevadaTax is our online system for registering filing or paying many of the taxes administered by the Department. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county.

Tax engagement letter 2020. Since Nevada does not collect an income tax on individuals you are not required to file a NV State Income Tax Return. 4810 for Form 709 gift tax only.

Added to NRS by 1987 2100 NRS 375A050 Taxable estate. The estate tax is on the estate of the deceased person before the inheritance gets disbursed. Estate tax planning in Nevada considers additional deductions that can be taken for qualified charitable deductions as well as administrative and legal costs involved in settling the.

For fiscal year estates and trusts file Form 1041 by the. Nevada currently does not have an estate. Nevada does not have state income tax.

However you may need to prepare and e-file a 2021 Federal. 8192005 31444 PM. With it you can manage your own tax account anytime.

It gets paid out of the estates funds. Resident or resident decedent means a decedent who was domiciled in Nevada at the time of his or her death. Any specific questions regarding exemptions and rates should be addressed to the.

Department of the Treasury. Current Bank Excise Tax Return Effective July 1 2011 An excise tax on each bank at the rate of 1750 for each branch office in excess of one maintained by the bank in each county in this.

Trusts And Estates Uses And Tax Considerations Journal Of Accountancy

9 States With No Income Tax Bankrate

Nevada Estate Tax Everything You Need To Know Smartasset

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

Avoiding Basis Step Down At Death By Gifting Capital Losses

Estate Tax Nevada Estate Planning And Probate

Nevada Real Estate Transfer Taxes An In Depth Guide

Moved South But Still Taxed Up North

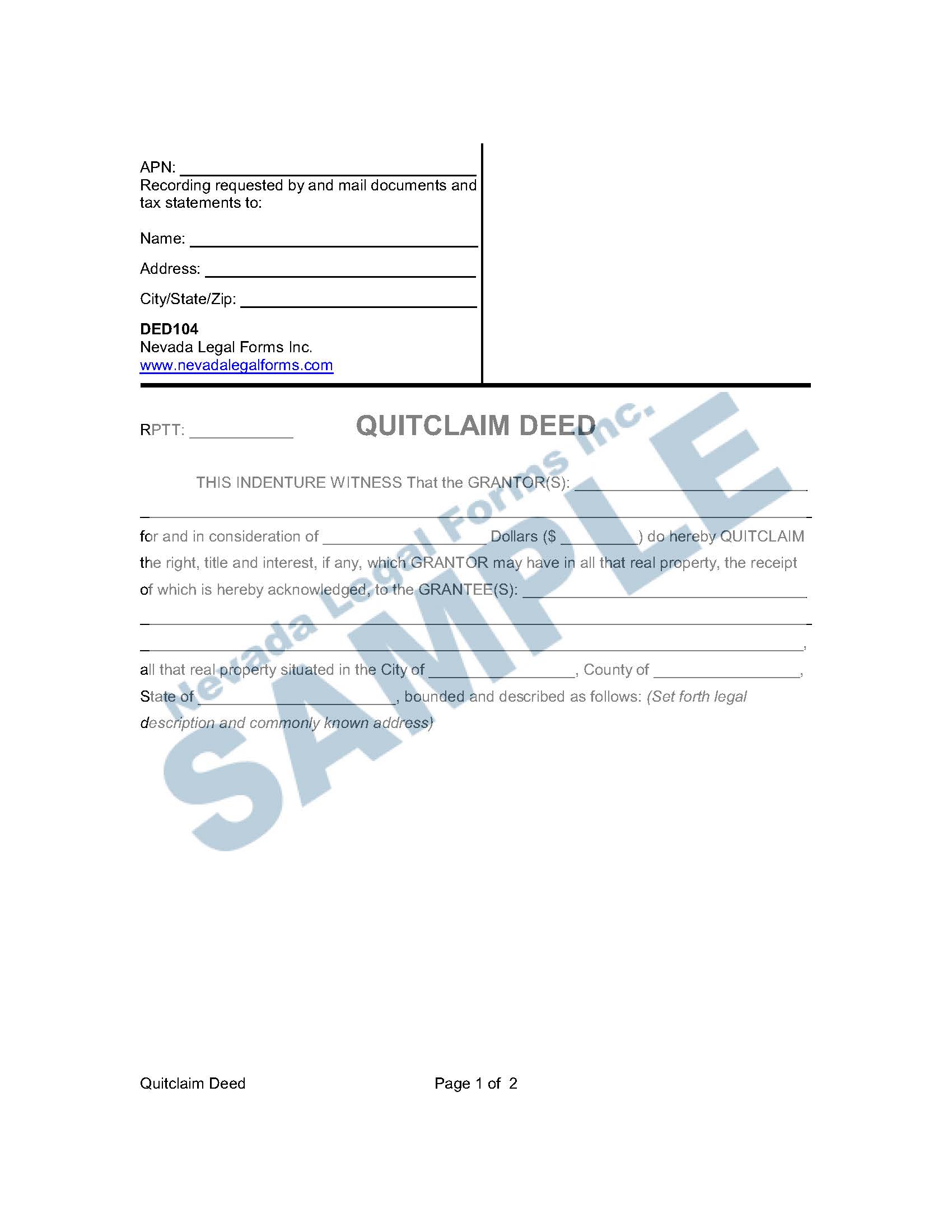

Quitclaim Deed Nevada Legal Forms Services

Establishing Nevada Residency Reno Nv Rsw Wealth Management

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Nevada Estate Tax Everything You Need To Know Smartasset

Dividing A Trust Into Subtrusts In Nevada

Nevada Estate Tax Everything You Need To Know Smartasset

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

:max_bytes(150000):strip_icc()/community-property-states-3193432_color-fc6662865d234709b76fe67cce591897.png)