south san francisco sales tax increase

The San Francisco Tourism Improvement District sales tax has been changed within the last year. 4 rows South San Francisco CA Sales Tax Rate.

Building Division City Of South San Francisco

South San Francisco 9875.

. Ex-South Bay Superintendent Looks At Unloading Condo To Taxpayers CBS-5 TV. The phone number for general tax questions is 1-800-400-7115. This is the total of state county and city sales tax rates.

The 2018 United States Supreme Court. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. 91912 Taxpayer group sues SCVWD over proposed parcel tax SJ Mercury News.

Did South Dakota v. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. South Laguna Laguna Beach 7750.

City of South San Francisco. City of South San Francisco. 5 rows The 9875 sales tax rate in South San Francisco consists of 6 California state sales.

The minimum combined 2022 sales tax rate for South San Francisco California is. South San Francisco Voters to Weigh In On New Sales Tax - South San Francisco CA - This Tuesdays election will be San Mateo Countys first all-mail election. Proponents of a sales tax increase in San Mateo County never say die.

South San Francisco 9875. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. San Rafaels sales tax increase goes from 90 to 925 percent which makes it the highest sales tax rate in Marin County.

Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent. City of San Mateo. San Francisco East Bay South Bay Peninsula North Bay.

The South San Francisco sales tax rate is. The Sales and Use tax is rising across California including in San Francisco County. The board would release 40 million to Caltrain in the first year of the tax replacing the combined 358 million that San Francisco and.

SANTA CRUZ - A sales tax increase could be in the cards for Santa Cruz again this summer. When the South San Francisco City Council requests voters grant them a sales tax hike like Measure W what are they sayin. The California sales tax rate is currently.

South Shore Alameda 10750. The raise was approved by California voters in the Nov. South El Monte 10250.

CA Sales Tax Rate. City officials said the tax raised 364 million in 2018-19 an amount expected to increase by 186 million after San Francisco voters approved Proposition I in November to increase levies on. SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1.

Measure W authorized the city to impose a 05 percent sales tax for 30 years. A sales tax measure was on the ballot for South San Francisco voters in San Mateo County California on November 3 2015. The County sales tax rate is.

Santa Clara County This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax 952. Bay Area house sells. For questions regarding property tax collection please call 650 363-4142.

The minimum combined 2022 sales tax. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. Voters asked to approve sales tax increase.

The hike came after voters passed two 05 percent tax hikes in 2020. February 8 2022 at 417 pm. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

The current total local sales tax rate in San Francisco CA is 8625. The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general fund to be used for. The December 2020 total local sales tax rate was 8500.

The South San Francisco California sales tax is 750 the same as the California state sales tax. South san francisco sales tax increase. Countywide Sales Tax Increase to Appear on November Ballot - South San Francisco CA - The San Mateo County Board of Supervisors voted to send the measure to the voters come November.

In San Francisco the tax rate will rise from 85 to 8625. South Lake Tahoe 8750.

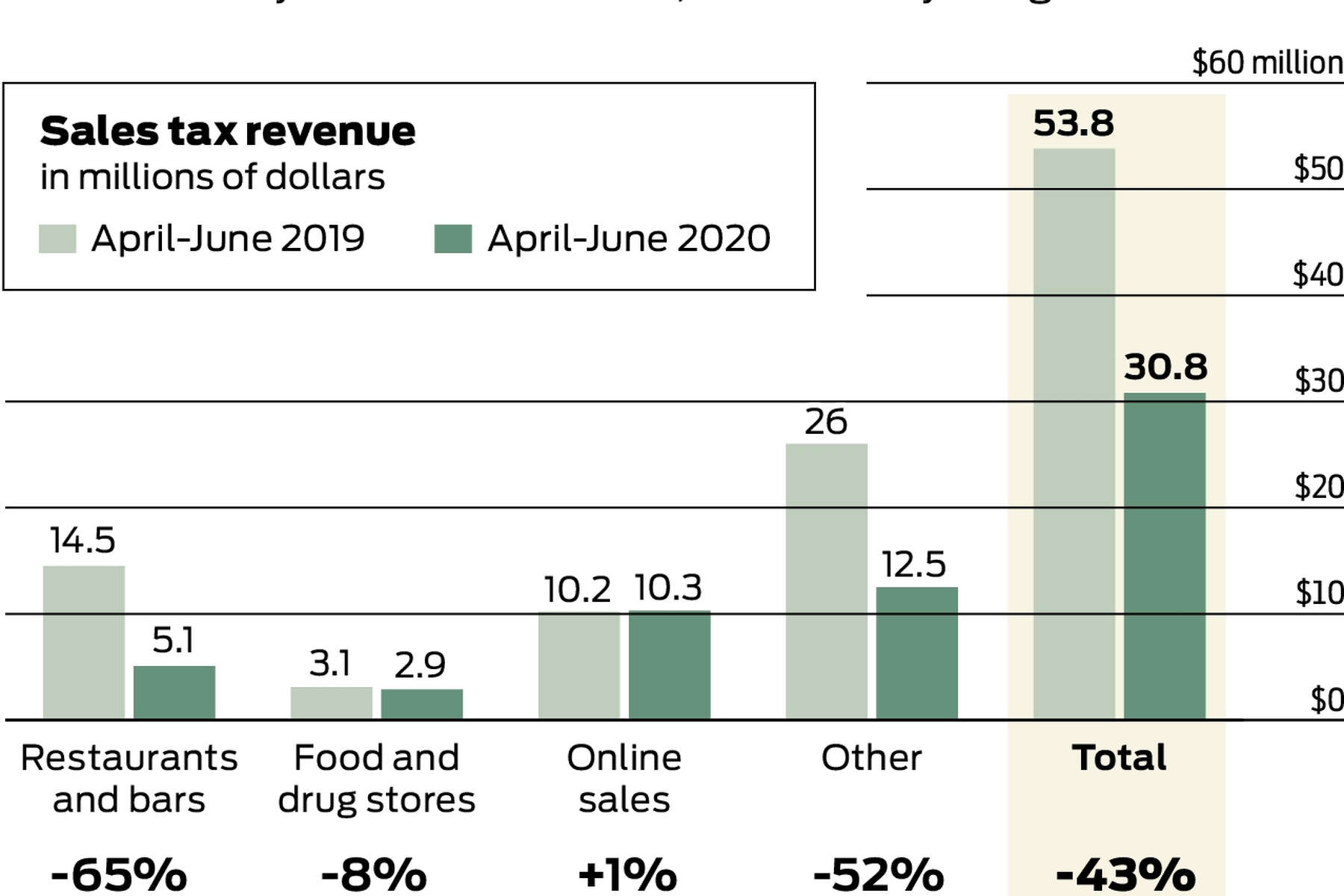

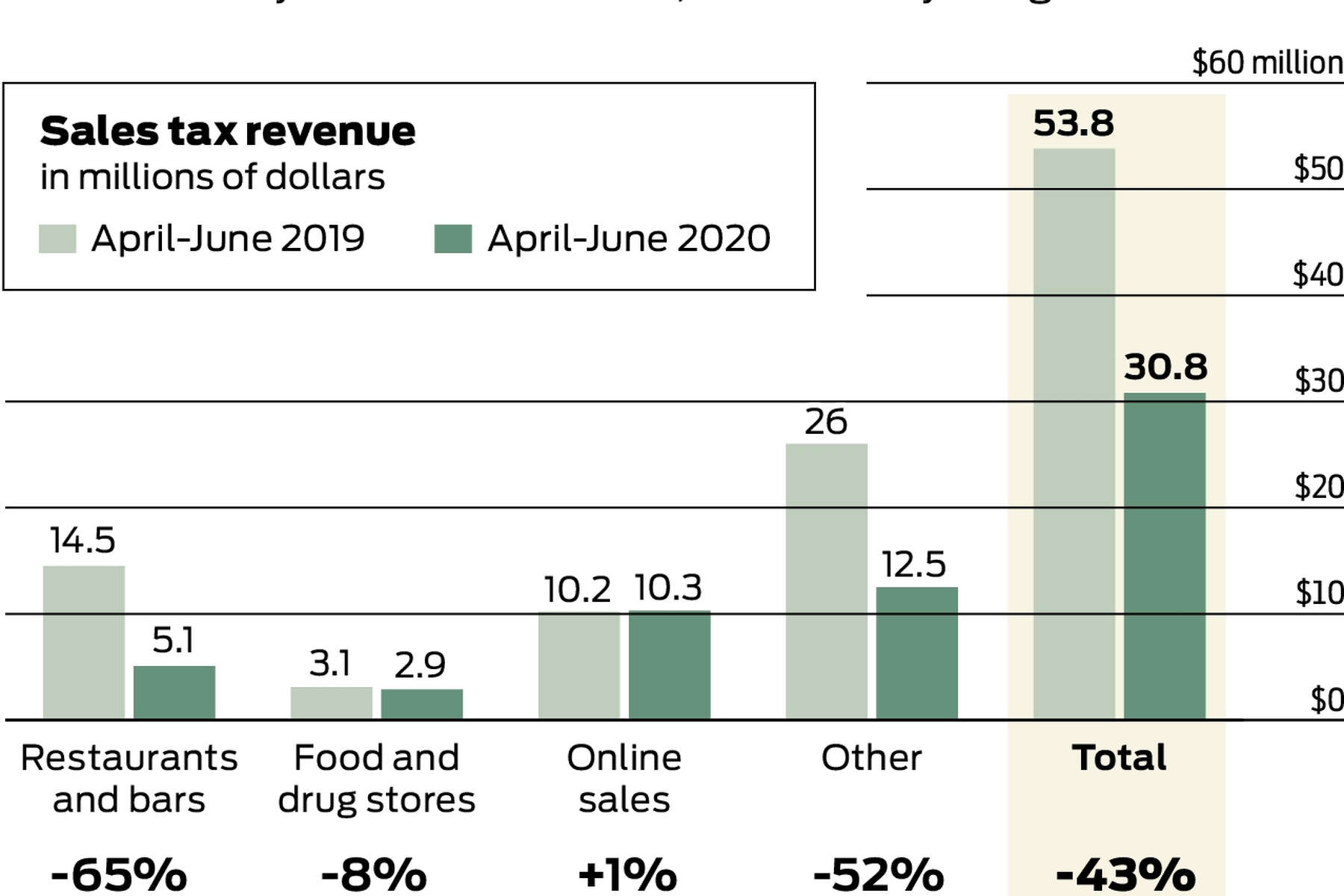

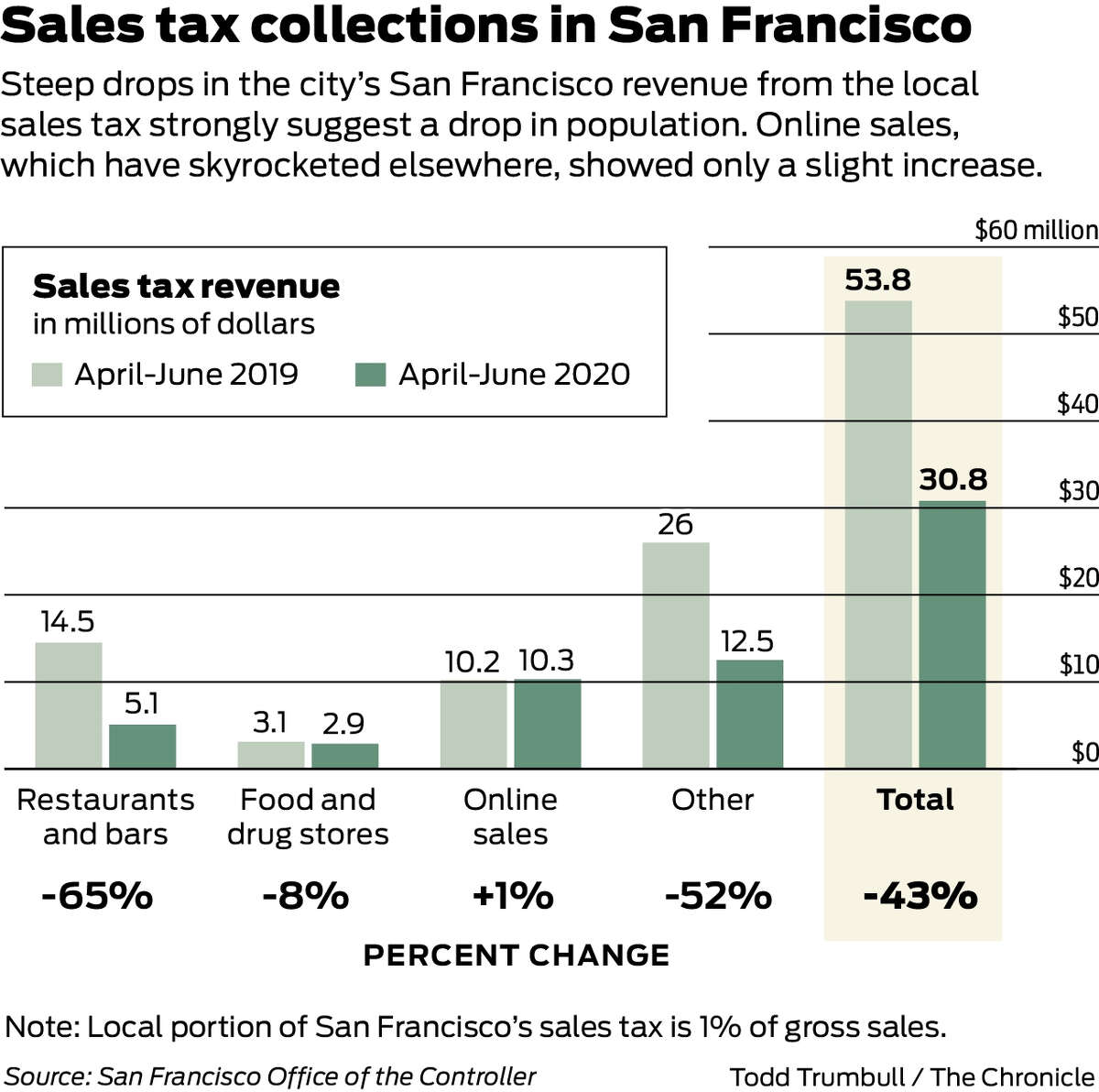

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

What Is It Like To Live In Westborough South San Francisco Top Things To Do Westborough Ssf Youtube

South San Francisco Ca Multi Family Homes For Sale Real Estate Realtor Com

Finance Department City Of South San Francisco

Measure W City Of South San Francisco

Avalon Park Neighborhood South San Francisco Ssf Neighborhood Guide Youtube

Recreation Division City Of South San Francisco

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco S New Local Tax Effective In 2022

Economy In South San Francisco California

Building Division City Of South San Francisco

Frequently Asked Questions City Of Redwood City

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

South San Francisco Ca Commercial Real Estate For Sale Loopnet Com

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Building Division City Of South San Francisco

Measure W City Of South San Francisco

Moving To Portland Here Are 17 Things You Should Know Extra Space Storage Moving To Portland Best Vacation Spots Oregon Travel