do you pay taxes on inheritance in indiana

Indiana has no state taxes on. Indiana repealed the inheritance tax in 2013.

Will My Heirs Be Forced To Pay An Inheritance Tax In California

How Much Tax Will You Pay in Indiana On 60000.

. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. This tax ended on December 31 2012. You are leaving assets to three different nieces.

Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an. To be honest most people will pay little if any inheritance tax. There is no federal inheritance tax.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. If you receive property in an inheritance you wont owe any federal tax.

There is no federal inheritance tax but there are a handful of states. Indiana repealed the inheritance tax in 2013. This gift-tax limit does not refer to the total amount you.

Each niece could be required to pay an inheritance tax. An inheritance tax is a tax on the property you receive from the decedent. Indiana does not have its own inheritance or estate taxes.

Instead some Indiana residents may have to pay federal estate taxes. For deaths occurring in 2013. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

This group includes the deceased persons parents children stepchildren grandparents grandchildren and other lineal. If you inherit 1 million from your married parents and that includes a home then the total tax liability is likely to be 50k - you. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana used to impose an inheritance tax. Inheritance tax rates differ by the state.

If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state. Indiana repealed the inheritance tax in 2013. As of 2021 the six states that charge an inheritance tax are.

The first rule is simple. Winners will be hit with a massive tax bill if they live in these states. Thats because federal law doesnt charge any.

November 7 2022 657 AM PST. How much can you inherit without paying taxes in Indiana. The Powerball jackpot is a record 204 billion.

What Are The Indiana Probate Laws Rice Rice

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

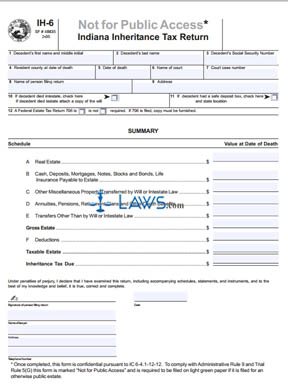

Free Form Ih 6 Indiana Inheritance Tax Return Free Legal Forms Laws Com

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Dor Make Estimated Tax Payments Electronically

Where Not To Die In 2022 The Greediest Death Tax States

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

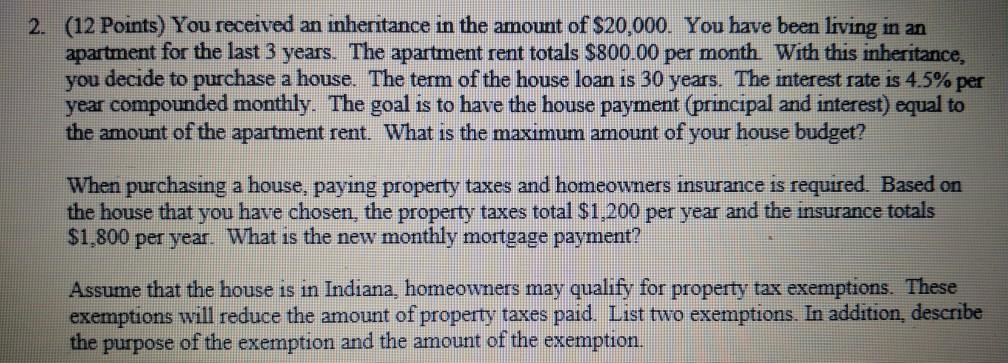

2 12 Points You Received An Inheritance In The Chegg Com

Indiana Estate Planning Laws Zentz Law Zentz Law

Is Inheritance Taxable In California California Trust Estate Probate Litigation

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

How Do I Assess An Estate For Inheritance Tax Purposes Low Fill Out Sign Online Dochub

Power Of Attorney Ih 28 Indiana

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller

How Do State And Local Sales Taxes Work Tax Policy Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group