california mileage tax rate

The state says it. Wednesday June 22 2022.

The standard mileage rate set by the IRS applicable in California is 625 cents per business mile from July 1st 2022.

. As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile. Under California Labor Code 2802 employers are required to reimburse employees for necessary expenses incurred in executing their job duties. 15 rows The following table summarizes the optional standard mileage rates for employees.

SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive. Suppose the homeowners total millage rate is 80 mills 801000 which implies that for every 1000 assessed value the homeowner owes 80 in property taxes. Rates 11 through 6302022 Rates 71 through 12312022.

Please contact the local office nearest you. 585 cents per mile. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty.

The Division of Workers Compensation DWC is announcing the increase of the. DeMaio warns voters across the state to be on the. 585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members.

December 11 2017 633 PM CBS San Francisco. 22 cents per mile. The relocationmoving mileage reimbursement rate for.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. The plan includes massive sales tax hikes along with a Mileage Tax of 4-6 per mile driven by San Diego commuters. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based.

The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out. For questions about filing extensions tax relief and more call. Rick Pedroncelli The Associated Press.

We require that you keep adequate records. For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile10They both increased. For historical mileage reimbursement rates please review the State Controllers Offices Payroll Procedures Manual Section N.

2021 Personal Vehicle Mileage Reimbursement Rates Unless. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of. The new rate for.

Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile. Online videos and Live Webinars are available in lieu. Standard mileage rate A more simplified method in which you multiply the business miles and the applicable published federal mileage rate.

625 cents per mile. Mileage Rate for Medical and Medical-Legal Travel Expenses Increases Effective July 1 2022. The mileage reimbursement rate for the first half of the year was 588 cents per mile.

18 cents per mile.

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

The Current Irs Mileage Rate See What Mileage Rates For This Year

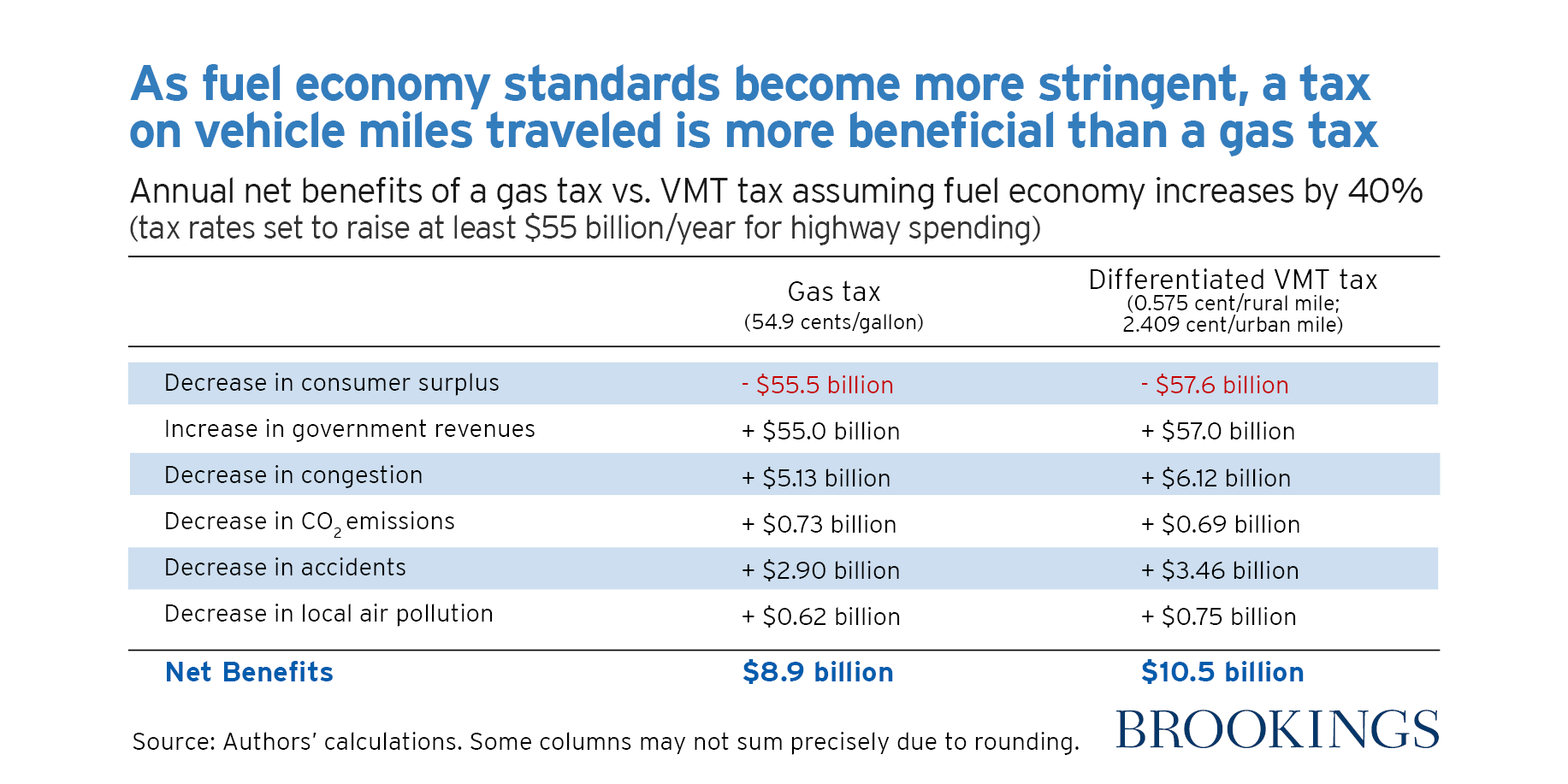

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

What Are The Mileage Deduction Rules H R Block

The Current Irs Mileage Rate See What Mileage Rates For This Year

Irs Mileage Reimbursement 2022 Everything You Need To Know About

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

How Much Will The 2022 Irs Standard Mileage Rate Impact Your Budget

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Irs Raises Standard Mileage Rate For 2022

County City Leaders Push Back Against Proposed Mileage Tax

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

The Current Irs Mileage Rate See What Mileage Rates For This Year

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

Mileage Reimbursement Calculator

Mileage Log Template Free Excel Pdf Versions Irs Compliant

The Current Irs Mileage Rate See What Mileage Rates For This Year

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group